When Demand Exceeds Supply; the Economics of Scarcity.

Do you remember when toilet paper was hard to get at the beginning of 2020? What about baby formula now? Would you pay more than normal to grab these scarce commodities? Can you afford increased prices? Are your wages keeping up with increased costs? How does increased demand and decreased supply affect your ability to move or change housing? How long will this last?

Shortages also apply to housing in both materials for new buildings and the availability of homes on the market. When a large number of people move into an area, they buy (or rent) most of the available housing. This causes scarcity so those who are selling or renting can demand higher prices. This is what is known as a seller’s market. Conversely, when the supply exceeds the demand, prices drop. That is a buyers’ market because sellers must lower prices to entice potential buyers. What does that mean for you?

Chains With Multiple Links

With supply chain problems becoming common, we can expect supply and demand issues for many of the things we commonly buy such as homes, gas, food, and utilities. Often, a shortage in one thing can affect many others. For instance, increasing gas prices mean that shippers and travelers must pay more. Manufacturers turn around and charge more to their buyers to cover shipping costs and they in turn charge more to the consumers. Travelers can afford to travel less often meaning hotels and restaurants lose money and this can lead to layoffs. Everything is interconnected in multiple little ways. And income almost never keeps up with inflation.

Rolling With the Flow

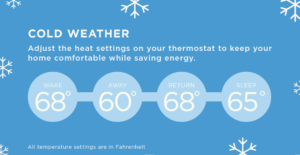

When in a recession or depression where costs exceed income, some adjustments need to be made to survive. There are multiple small ways to save such as turning down the heat in the winter and wearing a sweater. Or adjusting up the thermostat in the summer and enduring things a little warmer than you would prefer. Not buying name-brand items and getting the cheaper store brands instead is another way to save. Going for walks rather than going to the gym can save some cash as well. All those little adjustments add up to significant savings.

With housing, getting or adding a roommate may ease the financial burden. Make sure you check with your landlord first if you are renting as the roommate would likely need to be added to the lease. Waiting to make a home purchase may make more sense in the current market. Staying where you are for a bit longer may mean a better deal down the road.

If you have a property that you are not currently using, perhaps now would be a good time to rent it out. If you own your home, you could rent out a room. Make sure to do a thorough background check on any potential renter or use a property manager to do it for you. The downside is that sometimes personalities clash and situations change so have a plan for how you would deal with that and a strong lease agreement.

The Good News

Everything goes in cycles. We have had economic downturns before and will likely have them again. Lost jobs mean new opportunities in different and possibly better areas. Not being able to buy the property you want may mean there is something you haven’t seen yet that would actually suit you better. There is always a silver lining although it may be difficult to see right at the moment. A period of hardship creates an appreciation for when things are going well.

Housing prices and rents will reset to more affordable ranges. Your best chance of surviving the economic downturn is to be flexible. Nothing lasts forever. We have become a society that expects instant gratification but, in this case, it will cost you. Patience is the virtue that will win you the most reward in the long run.

Not all advice fits all situations so use what you can and discard the rest. If making changes is a necessity due to changes in employment or family situation, The Property Manager can help you find something that will suit your needs. If you aren’t time-pressed, just hang on. Things will get better, especially if you take small steps towards your goals every day.

https://www.investopedia.com/terms/l/law-of-supply-demand.asp

https://corporatefinanceinstitute.com/resources/knowledge/economics/cyclical-industry/